About Us

Our History & Mission

Over 20 Years Helping Arizona Families Plan Smarter, Live Freer, and Retire with Confidence.

Financial Planning Rooted in Service and Community

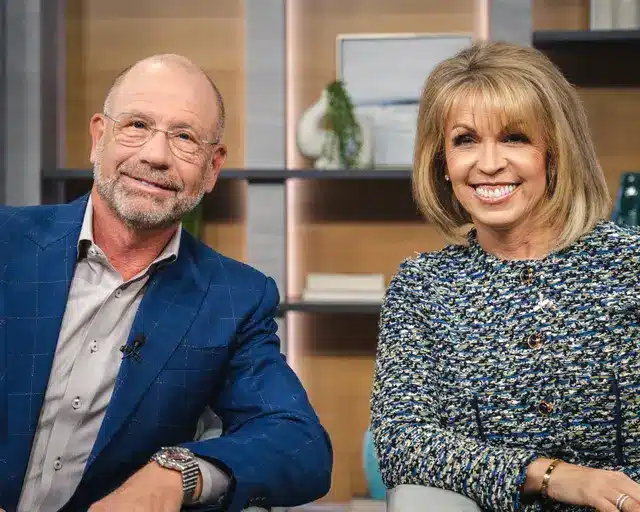

At Fullerton Financial, community has always been at the heart of everything we do. Since our founding in 2004, Steve and Stephanie Fullerton have built a company that reflects their deep passion for helping others achieve financial well-being. With a foundation rooted in the desire to serve our community through responsible financial stewardship, we’ve grown from a small consulting firm into a financial organization helping individuals and families across Arizona.

By providing clear financial guidance and empowering our clients to make informed decisions for their futures, we believe we can impact not only their lives but also the lives of future generations.

Where It All Began: Stephanie’s Mission to Serve Her Community

From the start, Stephanie recognized a gap in the market for clear, accessible financial advice—particularly for retirees. After 15 years as a women’s pastor, her passion for helping others led her to embark on a new venture to empower her community with the knowledge to secure their financial futures. This marked the beginning of what would eventually become Fullerton Financial Planning.

Stephanie Launches her New Company, Financial Planning for Seniors Inc.

In 2005, Stephanie launched her new business, Financial Planning for Seniors Inc., and began holding seminars designed to equip retirees with the knowledge needed for a secure future. As she sought to grow her business, she went the extra mile—literally—by meeting with clients in their homes, traveling as far as Prescott and Mesa. Through these personal consultations, she provided her clients with the tools necessary to ensure their financial needs were met throughout retirement. It wasn’t long before she knew this was her true purpose—guiding others toward lasting financial security so they could enjoy the retirement they always dreamed of.

Steve Partners with Stephanie to Open an Insurance Firm

While Stephanie’s client base grew, Steve Fullerton was completing a distinguished 20-year career in law enforcement. After retiring from the force, Steve wanted to partner with Stephanie in furthering her mission. To support her growing business, he cashed out his IRA, and together, they opened an insurance firm in Sun City, marking the start of their joint venture into financial services.

Steve and Stephanie Expand Their Services with Kingdom Financial Group

In 2010, Steve and Stephanie launched Kingdom Financial Group, a Registered Investment Advisor. This new venture enabled them to broaden their range of services, offering more options and advanced planning tools to better serve their clients’ diverse financial needs. As their reputation grew, so did their client base. By 2012, their rapid expansion prompted a move to a larger office to accommodate their growing team.

A Permanent Homebase is Built in Peoria

By 2015, the continued growth of the business exceeded their office capacity once again. To accommodate their expanding team and better serve their clients, Stephanie and Steve decided to build a new office in Peoria, establishing a more permanent home for Kingdom Financial Group.

Introducing Fullerton Financial Planning

With over 1,000 clients and $100M in assets under management, Stephanie and Steve rebranded their business, officially unveiling it as “Fullerton Financial Planning” in 2016. The new name signified their ability to offer a comprehensive range of financial services, reflecting their growth and commitment to serving a wider audience both within their community and beyond.

Expanding Outreach and Opening a Second Office

In the years following their rebrand, Steve and Stephanie’s business continued to thrive. In 2017, they debuted the Fullerton Financial Hour, offering local TV audiences free, actionable financial advice. By 2019, to better serve their growing client base in the East Valley, they opened a second office in Tempe, Arizona, expanding their reach to both current and future clients.

Milestones and Continued Growth

By 2021, Fullerton Financial reached a significant milestone, welcoming its 2,000th client. Today, Steve and Stephanie lead a team of nearly 40 financial professionals and are in the process of building a third office in North Scottsdale to further support their expanding client base.

A Year of Holistic Expansion

In 2024, Fullerton Financial Planning expanded its footprint with the opening of a third office in Scottsdale, Arizona—an important milestone in serving the growing needs of clients across the state. This year also marked the firm’s first local acquisition with the addition of IQ Wealth, a respected Valley-based firm. This strategic move not only enhanced Fullerton’s wealth management capabilities but also allowed the team to bring Steve Jurich’s 20+ years of experience into our group of experienced advisors, further broadening the services offered to clients. Alongside this, the launch of Fullerton Tax Services added in-house tax planning and preparation, reinforcing the firm’s commitment to delivering truly comprehensive, integrated financial solutions.

Begin the Conversation

Leverage Our Experience To Start Building Your Retirement Strategy.

Our Mission

Helping You Pursue Your Goals

We Offer a Comprehensive Retirement Planning Solution That Aims to Go Beyond Traditional Approaches.

We believe in cultivating a lifelong partnership with you built on trust, understanding, and personalized care to help you achieve the retirement of your dreams. To us, financial planning is more than just managing money—it’s about building a secure and fulfilling future for you and your family. Our commitment to your financial well-being goes beyond traditional approaches, offering a comprehensive and holistic path aiming to help you achieve your retirement goals.

See What Fullerton Can Do For You

Going from "I hope this works" to "I know I'm covered".

Experience You Can Trust

Retirement is too important to trust to a generalist. That’s why for over 20 years, Fullerton Financial Planning has focused exclusively on helping people transition from work to retirement — and thrive throughout it. We’re not trying to be everything to everyone. We’re built to help you do one thing incredibly well: Turn your life savings into reliable income and lasting financial confidence.

Why Families Across Arizona Trust Fullerton

- Over 20 years helping Arizona retirees create income that lasts

- Trusted by thousands of Arizona households

- Independent, fiduciary-based advice — no quotas, no product push

- Certified Financial Planner™ (CFP®) professionals on staff

- Regularly featured on ABC15, MoneyRadio, and financial education outlets

- Local, in-person service — no national call centers or rotating advisor teams

- Planning approach integrates investments, income, tax, Medicare, and legacy goals

- Collaborative relationships with CPAs, estate attorneys, and insurance professionals

- Focused on education-first guidance, not sales pitches or one-size-fits-all plans

- Supported by a dedicated client service team with a reputation for proactive care

“I was nervous about retiring — but they helped me see the whole picture and gave me confidence to move forward.”

— Mary J., Scottsdale

“They made a complicated plan feel simple. I wish we’d come here five years earlier.”

— Brian & Sandra T., Mesa

“They treated me like a person, not a portfolio. I never felt pressured — just supported.”

— Teresa D., Chandler

“Our old advisor never talked about income or taxes — this team gave us a plan we could actually live on.”

— Kevin M., Sun City

The Fullerton Family

Standing Strong For Clients.

Stepping Up For the Community.

Begin the Conversation with a Free Retirement Review

This isn’t a sales call. It’s a focused, one-on-one conversation about where you stand and what’s possible from here.

What We’ll Cover in Your Retirement Review

Lifestyle Goals

What do you want retirement to actually look like? Travel, freedom, family, security — we start with the life you want, then build around it.

Current Assets

We’ll review what you’ve built — and help uncover smarter ways to use your 401(k), IRA, or savings more effectively for retirement income.

Income Planning

We’ll identify where your income will come from — and how to make sure it covers what you care about without relying too heavily on the market.

Risk & Tax Exposure

We’ll evaluate how your plan holds up to taxes, longevity, healthcare costs, and market shifts — so your income stays steady, even when life doesn’t.

Long-Term Strategy

We’ll help you turn what you’ve saved into income that lasts — without sacrificing the lifestyle you worked so hard to build.

The Next Steps

By the end of the meeting, you’ll have clarity on what’s working, what’s missing, and what to do next.

What You Get With Fullerton

- A retirement income plan built around your lifestyle goals — not a generic formula

- A coordinated investment and withdrawal strategy that supports income for life

- Social Security timing guidance to help you get the most from your benefits

- A reliable income floor — often supported by high-quality annuities with GLWBs, when appropriate

- Tax-smart withdrawal strategies designed to adapt to changing laws and future needs

- Personalized guidance on Medicare and long-term care planning

- A clear roadmap for RMDs, Roth conversions, and income sequencing

- Legacy and beneficiary planning that protects your spouse and supports your values

- Ongoing reviews and proactive adjustments to keep your plan aligned as life evolves

- Direct access to your advisor — no call centers, no hand-offs

- A secure client portal with full access to your plan and documents

Invitations to Fullerton’s exclusive client events and appreciation gatherings - A local, retirement-minded community with shared goals and values

- Financial confidence for your spouse and family — with clarity, not complexity

- Experienced, time-tested guidance from a leading independent Arizona-based planning firm focused on your future

Income

Planning

A strategy to turn your savings into reliable, steady income — so your lifestyle stays on track in retirement.

Tax

Planning

Smart planning to reduce future taxes and keep more of your money working for you.

Health Care

Planning

Protection against rising healthcare costs, including long-term care, built into your plan.

Risk

Management

A clear approach to guarding your wealth from market swings, inflation, and the unexpected.

Estate

Planning

A plan for your assets and property that preserves your legacy and supports your loved ones according to your wishes.

Planning With Fullerton

Relationship Building

You’re not just another account. At Fullerton, every relationship begins with real conversation — taking time to understand your values, priorities, and goals. That connection becomes the foundation for a plan that’s built around you, not a formula.

Personalized Experience

No two retirements are the same. Your strategy will reflect your unique goals, lifestyle, and financial position. Everything is tailor-made: your income structured, your tax plan, and the preservation of legacy. The difference in the details — because it is built around you.

Holistic Approach

A good plan looks beyond the numbers. Your lifestyle, your family, your values — it’s all connected. That’s why our planning process considers every part of your life, not just your portfolio — leaving no stone unturned.

Begin the Conversation

We’re here to listen, understand, and help you take control of your financial future.