Retirement Planning

Rock Solid Retirement Plans Start with INCOME

Are you ready to take the longest unpaid vacation of your life? Yep — that’s retirement. You’re saying goodbye to your paycheck. From here, you have two options: One, Hope you don’t run out of money before you pass… Or…Two, Build a plan to create real income throughout retirement. The best retirement plans create income that replaces your paycheck, covers your expenses, and helps secure your lifestyle for the decades ahead.

Build an Income Plan That Carries You — Without Slowing You Down

Simply Put: It’s Always Better to Get Retirement Right the First Time.

You’ve saved. You’ve invested. You’ve built what most people spend their entire lives chasing. But now, as retirement approaches—or has already begun—something feels different… The stakes are raised and it’s time to call it like it is:

Retirement is like going on vacation for life.

Only this time, you’re not packing up for a week—you’re packing for the long haul… And your employer will no longer give you vacation pay.

Through the highs and lows of the market over the years, your paycheck always carried you through—paying the bills, funding your lifestyle, and keeping everything on track.

But with that paycheck going away, the question becomes simple:

How do you keep the bills paid when you’re not working anymore?

Can You Really “Save” Enough?

Sure, you could try to live off your savings.

But unless you have multiple millions of dollars tucked away, you’ll likely run out of money far too quickly — with no way of getting it back.

How Much to Save

According to recent research, the cost of a 30-year retirement can easily exceed $4 million for many couples — depending on lifestyle, inflation, healthcare, taxes, and geography.

Social Security to the Rescue?

Social Security helps, of course — and if you’re lucky enough to have a pension, that’s great too. But most people today don’t have a pension — let alone one generous enough to cover their desired lifestyle.

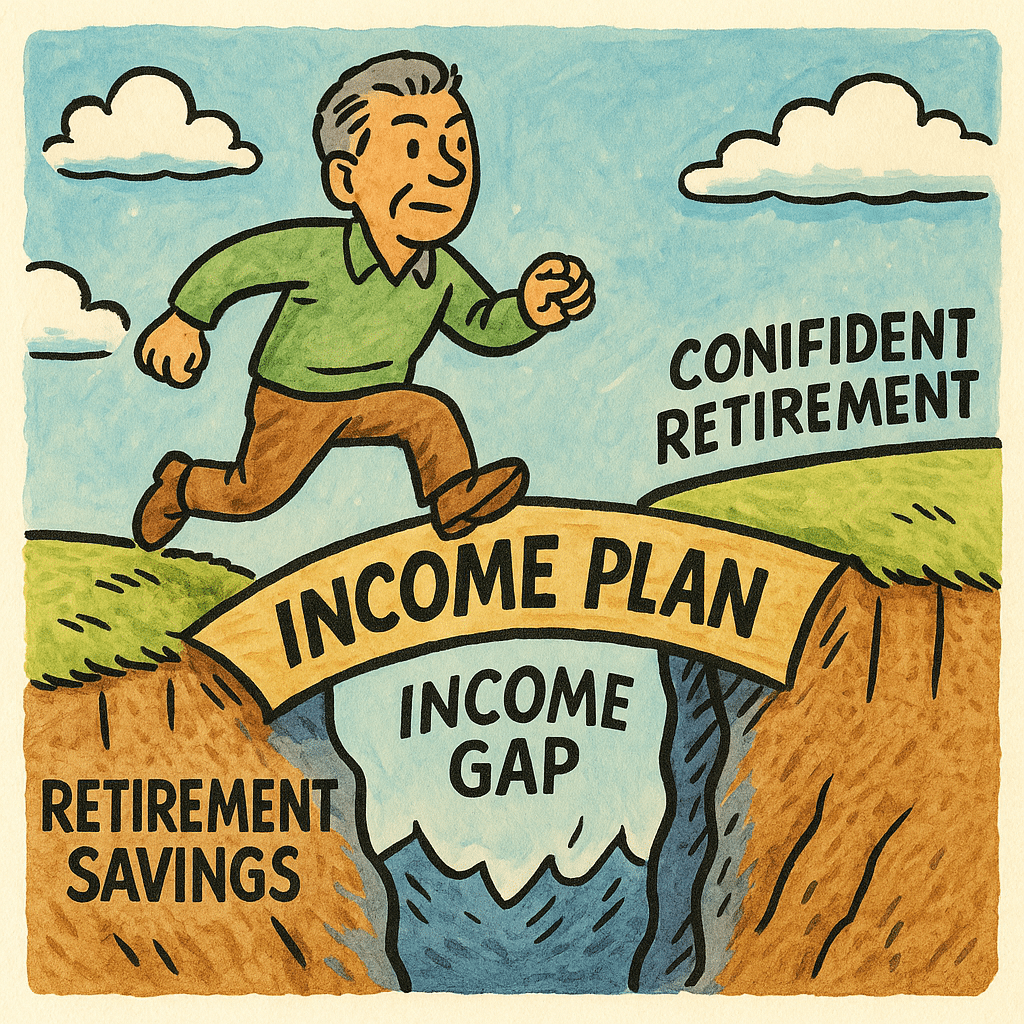

So what do we end up with? An income gap. A serious income gap.

Especially if you want to retire without sacrificing the life you spent years working for.

So naturally, you turn to your investments — the portfolio that got you to this point.

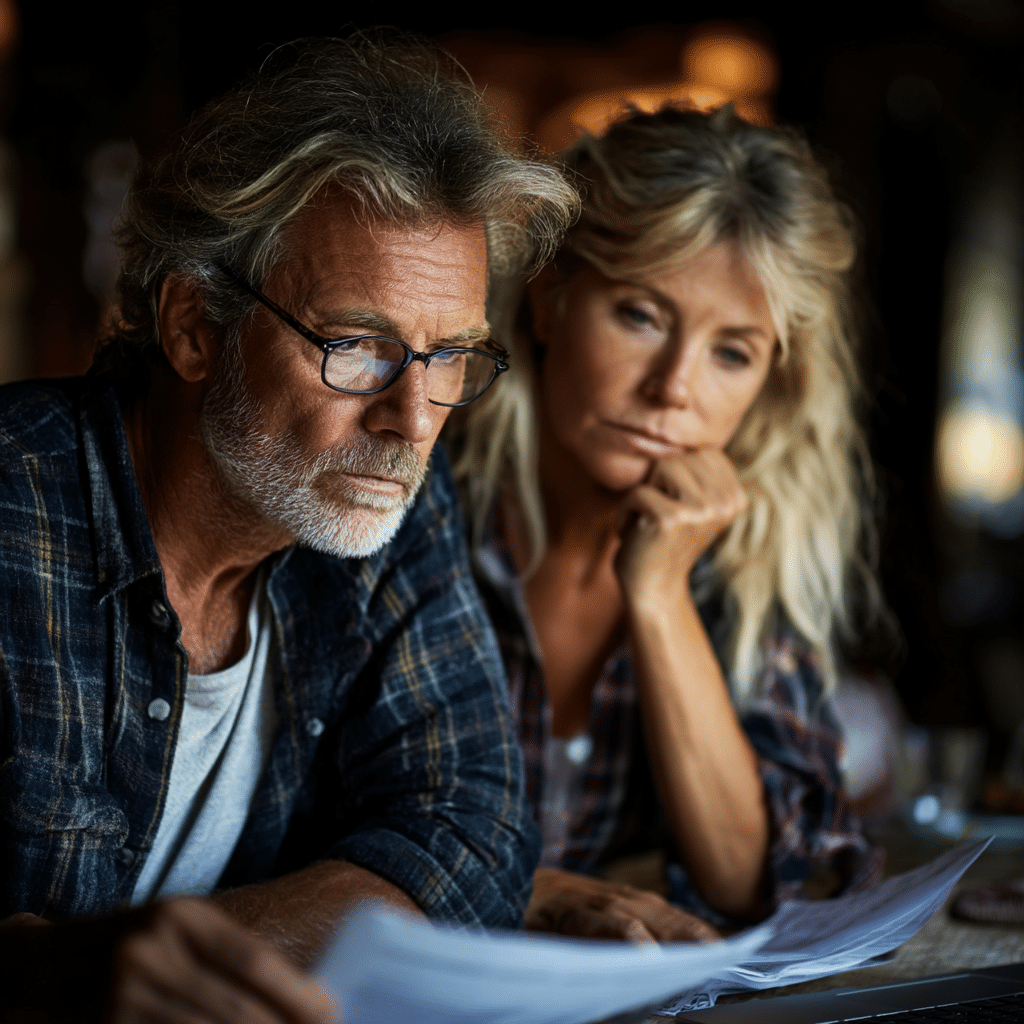

But here’s where most plans go wrong:

The strategies that helped you build wealth aren’t designed to produce consistent, dependable income—because you didn’t need it before… You still had a paycheck!

Did You Know?

A retiree who experienced negative market returns in the first few years of retirement had a 50–75% higher risk of running out of money, compared to one who experienced positive returns early — even if their average returns over time were identical.

Real Retirement Risk Factors

When you’re drawing income from investments, market volatility is no longer just noise — it’s a direct threat to your lifestyle. One bad year early in retirement can force you to sell low just to cover expenses… and that can damage your income potential permanently.

The math is simple. 5% of $500,000 is $25,000. But after an unfortunate market crash (like 1995, 2000, or 2008), your portfolio’s value could drop in half. $25,000 is now 10% of your portfolio. You need a very high return in order to sustain and not drain with that level of withdrawal.

Sure, the market will bounce back, but the story is completely different when you’re still working — and not relying on withdrawals for income. The more you withdraw, the slower your account will grow, with a higher likelihood that it won’t recover at all.

This is called sequence of returns risk — and it’s one of the biggest reasons retirees outlive their savings and find themselves trapped later in life.

But it’s not the only one.

There’s also:

- Longevity risk — living longer than your plan was built to handle

- Inflation risk — quietly eroding your purchasing power year after year

- Tax risk — paying more than you should because your withdrawals weren’t planned properly

- Healthcare risk — the rising cost of care that most people underestimate

- Spousal risk — what happens to your income plan if one of you passes away?

If I only had a… Generous Pension.

Most employers no longer offer lifetime pensions. They’ve moved to vehicles like 401(k)s — which are great for saving, but now leave it up to you to create reliable income. The good news? If managed correctly, those savings can be rolled over into a self-directed IRA (or Roth IRA) — giving you the tools to build real, personalized retirement income.

The problem is — most people were never taught how to do that.

And most advisors? They were trained to grow money, not to distribute it.

So now you’re here — standing on the edge of retirement — trying to answer a question that very few people are truly equipped to solve:

How do I turn what I’ve saved into income that lasts?

Begin the Conversation

Retirement Income planning starts with action. Get ahead of the curve and start early — not late.

The Right Retirement Income Plan Doesn’t Just Pay You — It Protects You

Retiring the Smart Way

This isn’t about chasing returns. It’s about building a plan that lets you live fully — without having to constantly watch the markets, worry about taxes, or question whether you’re still on track.

At its core, retirement income planning is about replacing your paycheck — in a way that’s dependable, tax-efficient, and built to last.

Here’s how that actually works:

1. Start with Your Lifestyle — and Your Assets

Before we ever talk numbers, we get clear on two things:

First: your life.

What does retirement actually look like to you?

Not just surviving — but thriving. Travel, hobbies, helping family, staying generous… what will it cost to live the life you want?

Second: your financial foundation.

What assets do you have available to generate income?

- 401(k) or 403(b)?

- Traditional or Roth IRA?

- Brokerage accounts?

- Real estate?

- Savings?

We look at where your money is, how it’s taxed, and when it’s accessible — because all of that will determine how much income you can reliably generate, and for how long.

When you pair your desired lifestyle with your available assets, we can start designing a strategy that fits you — not a generic rule of thumb.

2. Create a Protected Income Floor

This is the foundation of your retirement income plan.

Your essential and lifestyle expenses should never depend on whether the market has a good month.

So we start by building a reliable income floor — income you can count on, no matter what the economy or markets are doing.

This includes sources like:

- Social Security (properly timed and coordinated)

- Pensions (if available)

- And in some cases, guaranteed income tools like annuities

Not all annuities are created equal — and most of what’s out there doesn’t fit this kind of strategy. But certain types of annuities are specifically designed to generate high, dependable income without giving up control or flexibility. When appropriate, they can serve as a powerful way to close the income gap left by Social Security alone.

The goal here isn’t complexity — it’s confidence.

Knowing that your core income is covered gives you freedom to enjoy your retirement without wondering if the market will change your plans.

3. Position Investments for Growth — Without Relying Too Heavily on Them for Income

Your investments still play a key role in retirement — but their role needs to shift.

We review your portfolio to make sure it’s positioned for growth in retirement, not just accumulation. That often means reducing unnecessary risk, improving tax efficiency, and rebalancing to support your income plan.

Some assets may be used to generate guaranteed income when appropriate. Others may be better suited to grow and support future needs — like healthcare costs, travel, or legacy goals.

The key is this:

You shouldn’t be forced to rely too heavily on your investments for monthly income.

Because that’s when sequence-of-returns risk can do the most damage — and you end up making decisions based on market performance instead of your lifestyle goals.

4. Plan for Taxes Before They Happen

Most retirees don’t plan their taxes — they just pay them.

That approach can cost you tens or even hundreds of thousands of dollars over time.

We build a forward-looking tax strategy that coordinates:

- Required Minimum Distributions (RMDs)

- Social Security taxation

- Roth conversions

- Medicare income thresholds

- Withdrawal timing across tax buckets

The result? You keep more of what you’ve saved— and you gain the confidence of knowing you’re not heading into a surprise tax trap later in life.

5. Simplify and Coordinate Everything

You shouldn’t need a spreadsheet and five logins just to figure out if you’re okay.

We simplify the moving parts — so your plan is easy to follow, easy to manage, and fully aligned with your goals.

You’ll know:

- What you’re spending

- Where your income is coming from

- And how long it’s built to last

This isn’t about making your retirement more complicated. It’s about making it more dependable — and giving you a plan that adjusts with you over time.

The Result?

A retirement that feels more like living — and less like guessing.

You’ll still be informed. But you won’t be watching the market with a knot in your stomach. You’ll have structure. A process. A plan that supports the life you want — with room to adapt.

Because retirement shouldn’t feel like a question mark. It should feel like freedom.

Begin the Conversation with a Free Retirement Review

This isn’t a sales call. It’s a focused, one-on-one conversation about where you stand and what’s possible from here.

What We’ll Cover in Your Retirement Review

Lifestyle Goals

What do you want retirement to actually look like? Travel, freedom, family, security — we start with the life you want, then build around it.

Current Assets

We’ll review what you’ve built — and help uncover smarter ways to use your 401(k), IRA, or savings more effectively for retirement income.

Income Planning

We’ll identify where your income will come from — and how to make sure it covers what you care about without relying too heavily on the market.

Risk & Tax Exposure

We’ll evaluate how your plan holds up to taxes, longevity, healthcare costs, and market shifts — so your income stays steady, even when life doesn’t.

Long-Term Strategy

We’ll help you turn what you’ve saved into income that lasts — without sacrificing the lifestyle you worked so hard to build.

The Next Steps

By the end of the meeting, you’ll have clarity on what’s working, what’s missing, and what to do next.

What You Get With Fullerton

- A retirement income plan built around your lifestyle goals — not a generic formula

- A coordinated investment and withdrawal strategy that supports income for life

- Social Security timing guidance to help you get the most from your benefits

- A reliable income floor — often supported by high-quality annuities with GLWBs, when appropriate

- Tax-smart withdrawal strategies designed to adapt to changing laws and future needs

- Personalized guidance on Medicare and long-term care planning

- A clear roadmap for RMDs, Roth conversions, and income sequencing

- Legacy and beneficiary planning that protects your spouse and supports your values

- Ongoing reviews and proactive adjustments to keep your plan aligned as life evolves

- Direct access to your advisor — no call centers, no hand-offs

- A secure client portal with full access to your plan and documents

Invitations to Fullerton’s exclusive client events and appreciation gatherings - A local, retirement-minded community with shared goals and values

- Financial confidence for your spouse and family — with clarity, not complexity

- Experienced, time-tested guidance from a leading independent Arizona-based planning firm focused on your future

Income

Planning

A strategy to turn your savings into reliable, steady income — so your lifestyle stays on track in retirement.

Tax

Planning

Smart planning to reduce future taxes and keep more of your money working for you.

Health Care

Planning

Protection against rising healthcare costs, including long-term care, built into your plan.

Risk

Management

A clear approach to guarding your wealth from market swings, inflation, and the unexpected.

Estate

Planning

A plan for your assets and property that preserves your legacy and supports your loved ones according to your wishes.

Planning With Fullerton

Relationship Building

You’re not just another account. At Fullerton, every relationship begins with real conversation — taking time to understand your values, priorities, and goals. That connection becomes the foundation for a plan that’s built around you, not a formula.

Personalized Experience

No two retirements are the same. Your strategy will reflect your unique goals, lifestyle, and financial position. Everything is tailor-made: your income structured, your tax plan, and the preservation of legacy. The difference in the details — because it is built around you.

Holistic Approach

A good plan looks beyond the numbers. Your lifestyle, your family, your values — it’s all connected. That’s why our planning process considers every part of your life, not just your portfolio — leaving no stone unturned.

See What Fullerton Can Do For You

Going from "I hope this works" to "I know I'm covered".

Experience You Can Trust

Retirement is too important to trust to a generalist. That’s why for over 20 years, Fullerton Financial Planning has focused exclusively on helping people transition from work to retirement — and thrive throughout it. We’re not trying to be everything to everyone. We’re built to help you do one thing incredibly well: Turn your life savings into reliable income and lasting financial confidence.

Why Families Across Arizona Trust Fullerton

- Over 20 years helping Arizona retirees create income that lasts

- Trusted by thousands of Arizona households

- Independent, fiduciary-based advice — no quotas, no product push

- Certified Financial Planner™ (CFP®) professionals on staff

- Regularly featured on ABC15, MoneyRadio, and financial education outlets

- Local, in-person service — no national call centers or rotating advisor teams

- Planning approach integrates investments, income, tax, Medicare, and legacy goals

- Collaborative relationships with CPAs, estate attorneys, and insurance professionals

- Focused on education-first guidance, not sales pitches or one-size-fits-all plans

- Supported by a dedicated client service team with a reputation for proactive care

“I was nervous about retiring — but they helped me see the whole picture and gave me confidence to move forward.”

— Mary J., Scottsdale

“They made a complicated plan feel simple. I wish we’d come here five years earlier.”

— Brian & Sandra T., Mesa

“They treated me like a person, not a portfolio. I never felt pressured — just supported.”

— Teresa D., Chandler

“Our old advisor never talked about income or taxes — this team gave us a plan we could actually live on.”

— Kevin M., Sun City

The Fullerton Family

Standing Strong For Clients.

Stepping Up For the Community.

Leverage Our Experience

Retirement is our focus. See what over 20 years helping retiring clients can do for your future.

Still Wondering If This Is Right for You?

Here are some of the questions we hear most often — with straight answers to help you move forward confidently.

Q: How do I make sure I have enough to retire?

Q: How do I make sure I don’t run out of money later in retirement?

Q: What’s the best way to retire and not have to give up my lifestyle or be afraid of my budget?

Q: Why do I need more guaranteed income than just Social Security?

Q: How do I protect myself from future market downturns or crashes?

Q: When is the right time to retire?

The right time to retire is when you have a plan that works no matter what the economy is doing — one that protects your income, reduces your tax exposure, and supports your lifestyle with confidence.

We help you build that plan — so retirement becomes a decision based on your goals, not guesswork.

Q: How do I avoid being forced to go back to work or worse?

Q: How can annuities fit into my income plan?

Q: My current financial advisor still has me in risky investments. It feels wrong to me now that I’m older — but am I just worrying too much?

Q: I plan to retire in the next 10 years. Is it too early to begin planning?

Q: I want to retire sooner than 10 years… Am I too late to plan?

Q: How do I make sure my spouse is taken care of if I pass first?

Q: What changes to my investment strategy should I expect when transitioning to retirement?

Q: What does the Retirement Review cost?

Begin the Conversation

We’re here to listen, understand, and help you take control of your financial future.