SPEAK WITH A FINANCIAL ADVISOR TODAY | CALL (623) 974-0300

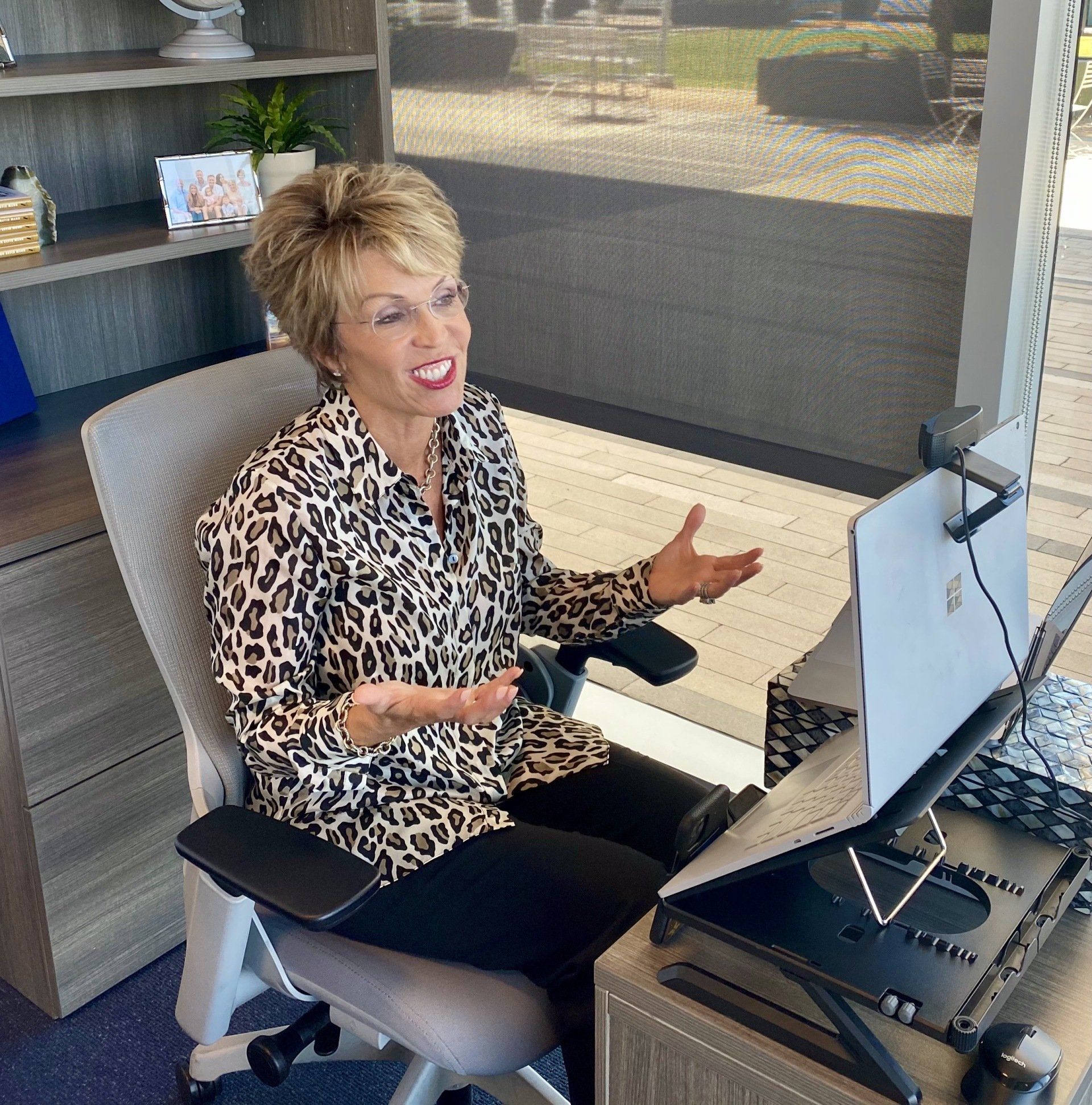

Webinars

On Your Screen

Join us for one of our webinars. We will be discussing important market trends, actions to take regarding your portfolio, and how to adjust your risk score based on your comfort. Join us from the comfort of your own home!

Our Newest Webinar

Navigating Medicare

Medicare can be complex, and we believe that informed choices lead to better outcomes.

By attending this webinar, you'll gain a solid understanding of how Medicare works,

enabling you to make choices that align with your unique needs and preferences.

Quarterly Commentary: 2023 Quarter 3

Access the enlightening on-demand webinar showcasing a comprehensive

recap of the 2023 Quarter 3 Market, featuring Steve & Stephanie Fullerton.

On-Demand Webinars

Our webinars focus on common financial concerns that individuals and families face in retirement, things like how to prepare for unexpected medical expenses and ways to create income to help support your desired lifestyle.

List of Services

-

The Power of IndexingWATCH NOW

Explore the vast possibilities of Indexed Universal Life Insurance as we delve into its captivating features and exceptional benefits in this engaging webinar.

-

Fixed Indexed AnnuitiesWATCH NOW

We are bringing you the quick tips and facts on Fixed Indexed Annuities. Listen to Stephanie provide the educational material you the reasons why you should consider an Indexed Annuity.

-

Tax Strategies for Your RetirementWATCH NOW

Taxes could be the single biggest factor impacting your retirement income. Join us as we discuss tax strategies that may benefit you--not the IRS.

-

Navigating MedicareWATCH NOW

Medicare can be complex, and we believe that informed choices lead to better outcomes. By attending this webinar, you'll gain a solid understanding of how Medicare works, enabling you to make choices that align with your unique needs and preferences.

Ready to Get Started?

Let's Meet!

For more information about any of our Phoenix products and services, schedule a meeting today.

CORPORATE OFFICE

14155 N. 83rd Ave., Suite 144

Peoria, AZ 85381

Phone: (623) 974-0300

Fax: (623) 974-0330

All Rights Reserved | Fullerton Financial Planning

Built by REV77